Missouri's New Temp Tag Law: What Arnold Car Buyers Need to Know About Sales Tax Changes

![[HERO] Missouri's New Temp Tag Law: What Arnold Car Buyers Need to Know About Sales Tax Changes](https://cdn.marblism.com/2CoRzgAnT5D.webp)

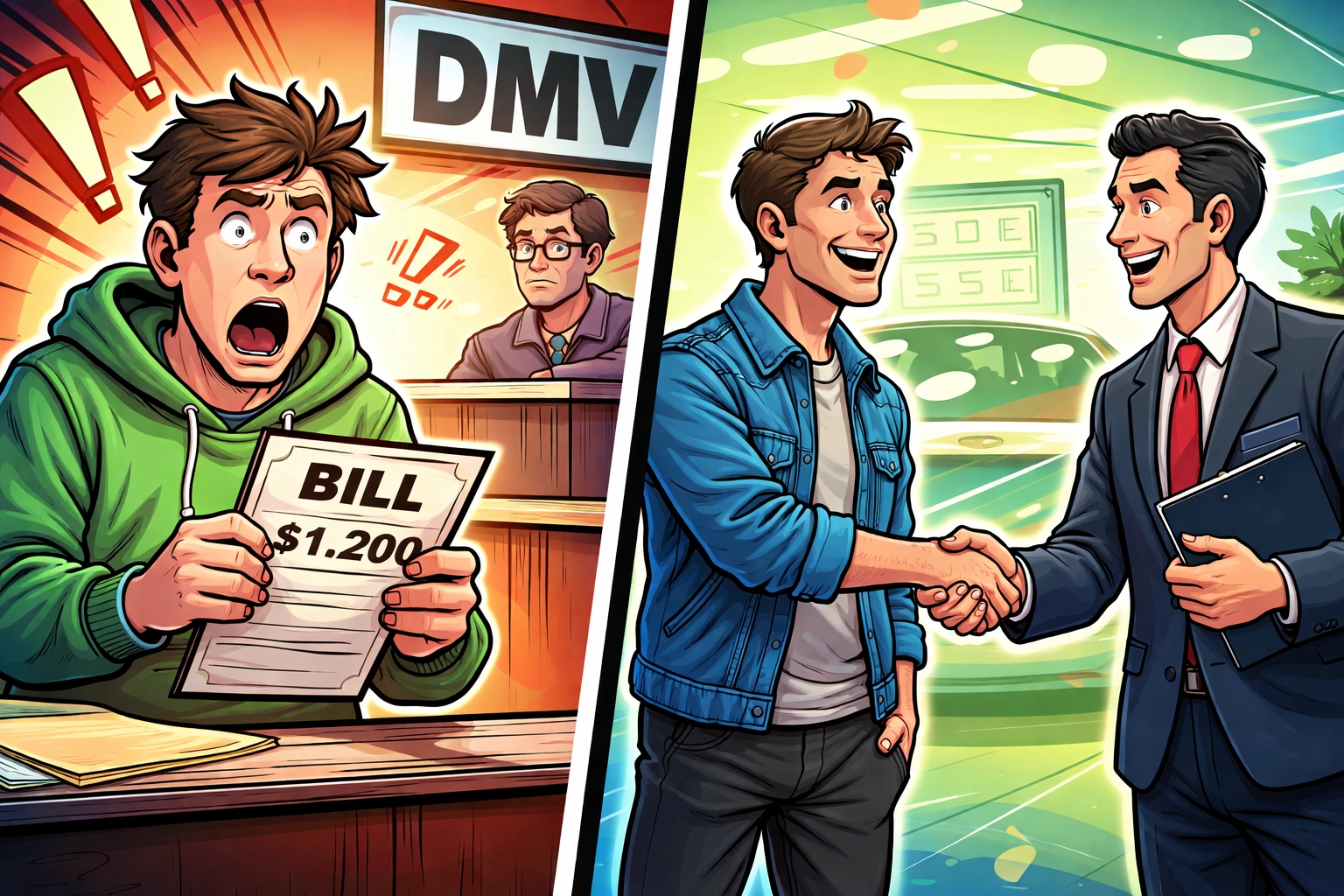

If you've bought a car in Missouri before, you know the drill. You drive off the lot with a temporary tag, feeling great about your new ride. Then, within 30 days, you head to the DMV to pay your sales tax and get your permanent plates. And that's when it hits you , the "DMV sticker shock."

That extra chunk of money you weren't quite prepared for? Yeah, it catches a lot of Arnold car buyers off guard.

But here's the good news: Missouri is changing the game. A new law is on the way that will eliminate temporary tags entirely and require dealerships to collect sales tax at the point of sale. For buyers in Arnold, MO, this means no more surprise bills at the license office. Let's break down everything you need to know about the Missouri temp tag law 2026 changes and how they'll affect your next car purchase.

What Is the New Missouri Temp Tag Law?

Missouri lawmakers passed Senate Bill 28, which overhauls how vehicle sales tax is collected in the state. The goal is simple: streamline the car buying process and close a revenue gap caused by expired temporary tags.

Here's the basic rundown of what's changing:

Sales tax collected at the dealership: Instead of paying sales tax at the DMV within 30 days, you'll pay it right at the dealership before you drive off.

No more temporary tags: Those paper temp tags in your back window? They're going away.

Permanent plates mailed to you: After your purchase, you'll receive a paper placeholder plate. Your actual metal plate will be mailed directly to your home.

This is a pretty significant shift from how things have worked in Missouri for decades. But once the new system is up and running, it should make the whole car registration process in Arnold, MO a lot smoother.

When Does the Missouri Car Sales Tax Change Take Effect?

Here's where things get a little tricky. While Senate Bill 28 officially took effect on August 28, 2025, the actual implementation is still on hold.

Why? The Missouri Department of Revenue needs to complete its new motor vehicle system called FUSION before the sales tax collection changes can begin. That system is currently in development and isn't expected to be fully operational until late 2026 or early 2027.

So, for now, if you're buying a car at a dealership in Arnold, MO, the traditional process still applies:

You purchase the vehicle and receive a temporary tag.

You have up to 30 days to visit a Missouri license office.

You pay your sales tax and registration fees at the license office.

You receive your permanent plates.

Once the FUSION system goes live, that process will change. But until then, business as usual.

How This Helps Arnold Car Buyers Avoid "DMV Sticker Shock"

Let's talk about why this change actually matters for folks buying used cars in Arnold, MO.

The current system has a built-in problem. When you buy a car, your focus is on the purchase price, your down payment, and your monthly payment. Sales tax feels like a separate thing , something you'll deal with later.

But "later" comes fast. And when you show up at the DMV with your paperwork, you're suddenly hit with a bill that can be hundreds or even thousands of dollars. On a $15,000 vehicle in Jefferson County, you're looking at roughly $1,200 or more in sales tax alone. Add in title fees, registration fees, and plate costs, and it adds up quick.

That's DMV sticker shock. And it catches a lot of first-time buyers and folks on tight budgets completely off guard.

The new Missouri car sales tax system fixes this by rolling everything into the dealership experience. You'll know your total cost , including sales tax , before you sign anything. No surprises. No scrambling to find extra cash a few weeks later.

How the New Law Impacts Your Total Loan Amount

Here's something a lot of people don't think about: when you finance a vehicle, the sales tax isn't always included in the loan.

Under the current system, many buyers finance the vehicle price but pay sales tax out of pocket at the DMV. If you don't have that cash set aside, it can create a real problem.

With the new system, dealerships will have the option to include sales tax in your financing. That means your total loan amount may be slightly higher, but you won't have a separate bill waiting for you down the road.

Let's look at a quick example:

Yes, your monthly payment might be a little higher if you roll tax into the loan. But for many buyers, having one predictable payment is way easier to manage than getting hit with a lump sum a few weeks after purchase.

At Grateful Motors, we already work with buyers to make financing as transparent as possible. If you're rebuilding your credit or working with a tight budget, knowing your true total cost upfront makes a huge difference.

What About Private Party Sales?

If you're buying a car from a private seller (not a dealership), the new law doesn't change much for you.

You'll still need to:

Get a bill of sale from the seller.

Visit a Missouri license office.

Pay your sales tax and registration fees.

Receive your plates.

The sales tax collection changes only apply to dealership purchases. So if you're buying from a friend, family member, or someone on Facebook Marketplace, plan on handling the tax and registration yourself at the DMV.

What Should Arnold Car Buyers Do Right Now?

Since the new system isn't live yet, here's what we recommend for anyone shopping for a vehicle in Arnold, MO today:

1. Budget for Sales Tax Separately

Until the FUSION system launches, you'll still need to pay sales tax at the DMV. When you're planning your purchase, set aside at least 8-10% of the vehicle price for tax, title, and registration fees. This way, you won't get caught off guard.

2. Ask About Tax-Inclusive Financing

Some dealerships, including Grateful Motors, can help you include sales tax in your financing if that works better for your situation. Just ask : we're happy to walk you through the options.

3. Keep an Eye on the Timeline

The Missouri Department of Revenue is working on the FUSION system, but there's no exact launch date yet. We expect things to roll out in late 2026 or early 2027. When that happens, we'll update our process and make sure every buyer knows exactly what to expect.

4. Don't Wait If You Need a Car Now

If you need reliable transportation today, don't put off your purchase waiting for the new law. The current system works fine : you just need to plan for that DMV visit. And if you're worried about credit or financing, we've got options for bad credit, no credit, and credit rebuilding.

The Bottom Line for Arnold, MO Car Buyers

Missouri's new temp tag law is coming, and it's going to make buying a car a lot more straightforward. No more temporary tags. No more surprise tax bills at the DMV. Just a clean, simple process where you know your total cost before you drive off the lot.

Until the new system goes live, the team at Grateful Motors is here to help you navigate the current process and plan for whatever comes next. We believe in transparency, flexible financing, and treating every customer like a neighbor : because that's exactly what you are.

Ready to find your next ride? Browse our inventory or give us a call at 636-326-CARS. We'll make sure you know exactly what to expect, whether you're buying today or waiting for the new Missouri car sales tax rules to kick in.